Introduction – The Evolving Landscape of Pigment Manufacturing

In 2025, the pigment manufacturing industry is entering a phase of unprecedented transformation. With global market value expected to surpass USD 40 billion, companies are under pressure to deliver more sustainable, efficient, and performance-oriented solutions. Environmental regulations, customer awareness, and digitalization are driving a new era of innovation.

1. Shift Toward Sustainable and Bio-Based Pigments

Sustainability has become the defining trend of the decade. Manufacturers are moving away from petroleum-derived feedstocks toward bio-based alternatives such as lignin, algae, and natural minerals. This shift not only reduces environmental impact but also supports compliance with global carbon-reduction goals.

In Europe and North America, major producers like BASF and Clariant are developing bio-pigments derived from renewable feedstocks, while in Asia, emerging companies are leveraging agricultural waste for pigment synthesis. For example, rice husk ash and palm waste are now explored as silica sources in pigment formulations.

This transition is not only environmental—it is also economic. Bio-based pigments help companies avoid volatility in petrochemical pricing and improve brand image among eco-conscious clients.

2. Digitalization and Smart Manufacturing in Pigment Plants

Digital transformation is revolutionizing pigment manufacturing. From automated weighing systems to AI-driven quality control, plants are adopting Industry 4.0 technologies to improve consistency and reduce human error.

In China and South Korea, pigment plants are using IoT sensors to monitor particle size, moisture, and temperature during synthesis. These data points feed into machine learning models that automatically adjust process parameters.

This has led to a 20–30% improvement in production efficiency and reduced waste by up to 15% in some facilities. As predictive analytics and robotics advance, smart pigment plants will become standard across the industry.

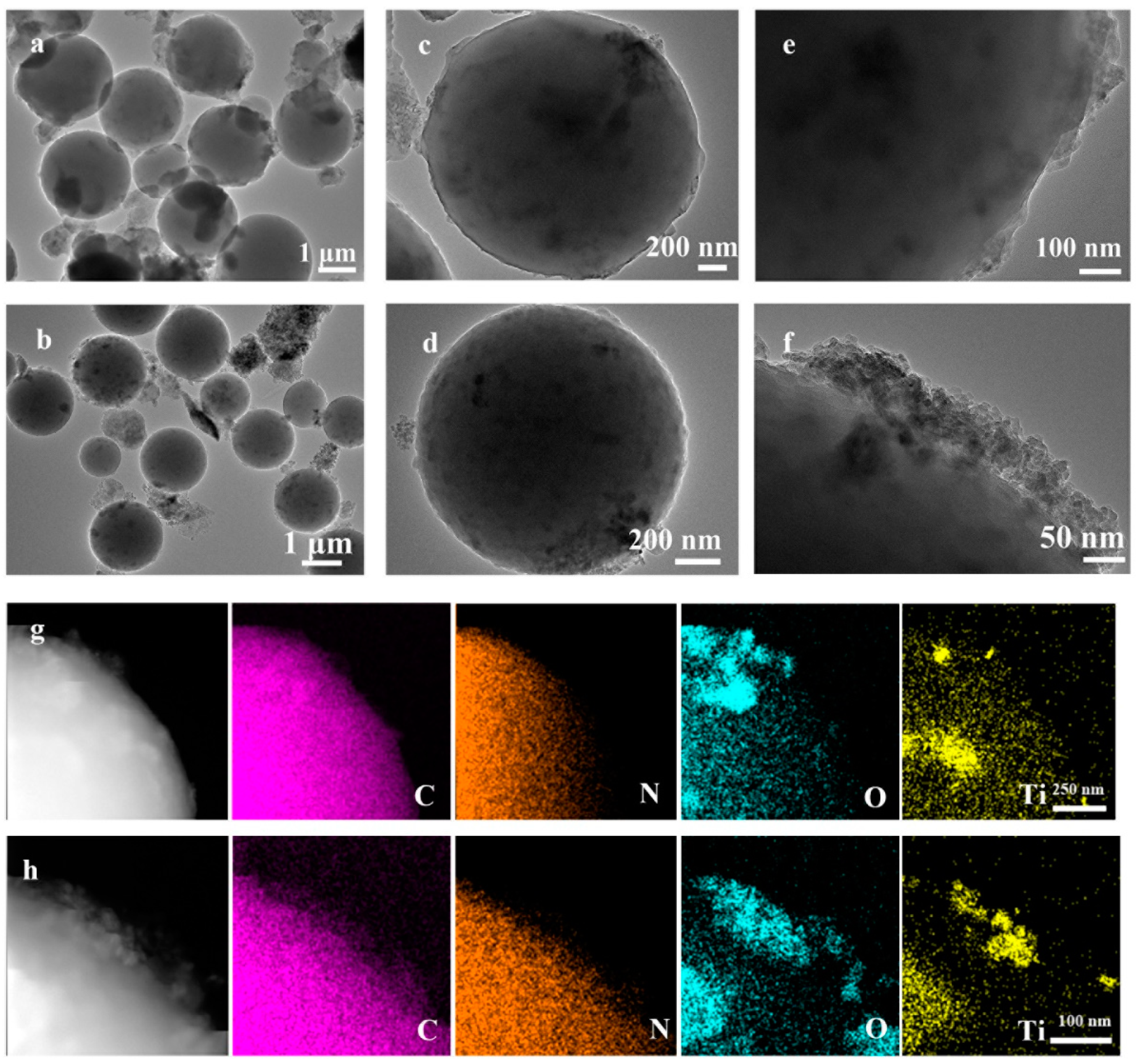

3. Nanotechnology-Enhanced Pigments

Nanotechnology remains a catalyst for product innovation. Nano-pigments provide richer color tones, enhanced UV stability, and superior surface smoothness.

In 2025, nano pigments are increasingly used in automotive coatings, 3D printing inks, and electronic displays. For example, titanium dioxide nanoparticles improve brightness and durability in architectural paints, while iron oxide nanoparticles are favored for anti-corrosive primers.

However, regulatory scrutiny of nanoparticles is tightening. Manufacturers must comply with REACH nanomaterial guidelines, ensuring safe use without compromising innovation.

4. Rising Demand for Functional Pigments

Beyond aesthetics, pigments today must perform. Functional pigments offer UV protection, infrared reflection, or antibacterial properties.

For instance, heat-reflective pigments reduce surface temperatures in automotive and roofing applications, improving energy efficiency. Meanwhile, photochromic and thermochromic pigments are being used in smart coatings and textiles.

According to MarketsandMarkets, the functional pigment market is projected to grow at CAGR of 6.8% through 2030, signaling robust demand across sectors.

In China, a growing number of pigment manufacturers are accelerating the transition to high-performance functional pigments, and Fineland Chem’s R&D team continues to launch tailor-made high-performance functional pigments specifically for industrial coatings applications.

5. Globalization and Regional Production Shifts

The center of gravity for pigment production is moving east. Asia-Pacific, especially China and India, now accounts for over 55% of global pigment output.

This shift is driven by access to raw materials, lower energy costs, and robust logistics. However, European producers are repositioning by focusing on high-value specialty pigments to retain competitive advantage.

6. Circular Economy and Waste Reduction

Circular production is no longer optional — it’s an industry imperative.

Pigment plants are investing in wastewater treatment, solvent recovery, and byproduct valorization. For instance, iron oxide waste is now reused in concrete coloring, while solvent vapors are captured for reuse in future batches.

Some companies like Lanxess have developed closed-loop manufacturing systems that recover up to 95% of process water, significantly reducing environmental impact.

7. Advanced Testing and Color Measurement Technologies

As pigment formulations become more complex, digital precision in color control has become vital. Modern labs now use spectrophotometers, digital cameras, and AI-based software to monitor every batch.

Moreover, AI algorithms now predict pigment stability under varying conditions, significantly shortening development cycles while improving quality control.

Spectrophotometers, machine vision cameras, and AI-assisted software can now detect minor deviations invisible to the human eye. Cloud-based color libraries allow instant sharing of digital color codes between manufacturers and clients worldwide.These technologies reduce rework rates by up to 30%, improving profitability and customer satisfaction.

8. Mergers, Acquisitions, and Strategic Partnerships

The pigment industry continues to consolidate. Large corporations are acquiring smaller innovators to diversify portfolios, while joint ventures focus on developing smart pigment systems that respond to temperature, light, or electrical signals.

These mergers help companies expand product portfolios, access patented technologies, and strengthen supply chains. Partnerships between pigment suppliers and coating manufacturers are enabling joint product development for customized applications.

9. Customization and High-Performance Pigments

The modern pigment market demands color precision and durability. Customers expect pigments that perform consistently under extreme environments—UV exposure, temperature variation, or chemical stress.

To meet these expectations, R&D centers are using simulation tools to predict pigment behavior before production. High-durability pigments for automotive coatings and outdoor architecture are among the fastest-growing categories.

10. Regulatory Pressures and Future Compliance

Conclusion – The Future Outlook for Pigment Manufacturing

The pigment manufacturing sector stands at the intersection of innovation and responsibility. Companies that embrace smart production, eco-design, and R&D collaboration will define the next generation of sustainable color solutions.

According to Fact.MR, the pigment market will continue to expand steadily through 2030, driven by green chemistry and digital innovation.